It’s easy to acquire customers. Almost anyone can do it – all the way from the initial contact to the closing of the deal. What’s challenging is retaining those customers! If you don’t improve your relations with existing customers, they are more likely to churn, i.e., quit doing business with you. If you haven’t given much thought to it, it’s about time you did. Keep reading to learn more about churn rate, its calculation, strategies to reduce it, the importance of customer retention, and more.

What is Churn Rate?

It is one of the essential metrics for subscription-based companies. The churn rate refers to the percentage of customers who stop paying for your product or service during a given period. If your typical customers don’t stick around long enough for you to redeem your average CAC (customer acquisition cost), you are in trouble.

Customer churn can be divided into two categories – Voluntary and Involuntary.

- Voluntary Churn: when the customers consciously stop using your products/services. It may result from dissatisfaction, or they no longer need the product/service, or they found a better brand.

- Involuntary Churn: when external factors force the customers to stop buying from you. For example – incorrect card details, insufficient funds, wrong address, or other reasons unrelated to your brand.

How to calculate?

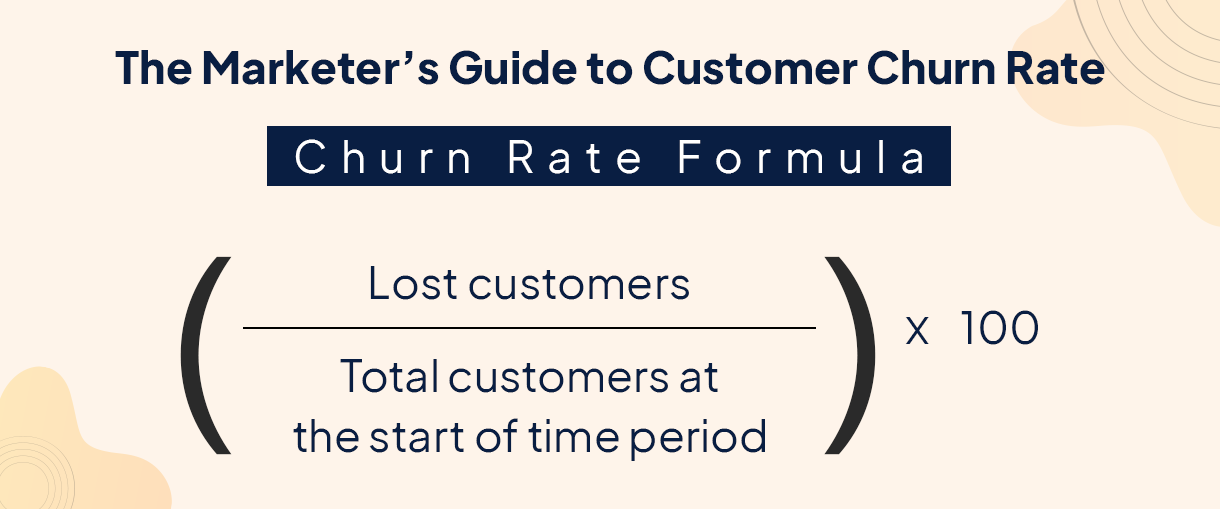

Mathematically, the churn rate is calculated as,

Churn Rate = [Total no. of customers lost / Total no. of customers at the start of the period]*100

For example, you had 1000 active customers at the beginning of the month, and by the end of the month, you lost 30. It means your churn rate is 3%. Easy, right? Let’s move on. In the following section, we will learn why knowing your churn rate is essential.

Why should you know your churn rate?

Knowing your churn rate is crucial as it will help you understand your brand’s strengths and pain points. Furthermore, it will give you an idea of the no. of customers dropping off your customer list every month and the reasons behind the churn. Finally, knowing the problem areas will help you take the necessary steps to retain customers before it’s too late.

Below are five top reasons for keeping track of your churn rate:

1. Directly impacts revenue

Your brand revenue is inversely proportional to the churn rate. The higher the churn rate, the slower the growth. The churn rate is the decelerator of your growth rate. Ignoring your churn rate may cost you in the future. Any company is sooner or later bound to suffer from high churn rates if not taken care of initially.

2. Influences your word-of-mouth marketing (WoMM)

WoMM is the process of encouraging natural discussions about your products, services, or brand. Often people subscribe to a product/service because someone they trust told them about it. But that doesn’t mean people won’t leave if you fail to meet their expectations. Simply put, the churn rate reflects how well you meet customers’ expectations.

Though churn rate doesn’t necessarily mean dissatisfaction, it indicates a need to improve your WoMM.

3. Early indicator of bad news for your business

The churn rate gives you a heads-up for the spike in your numbers. It may be due to increased pricing, negative feedback on product changes, negative publicity, or your competitors might be poaching your customers. Whatever the reason, knowing your churn rate will offer you an opportunity to mend the wrongs.

4. Customer lifetime value variable

Customer Lifetime Value (CTV) estimates how much a customer will spend on your product or service. It is calculated as follows:

LTV = Average monthly revenue per customer / Average monthly churn rate

Clearly, churn rate enables calculations of other marketing metrics. Hence, making it a staple in your analysis would be best.

5. Proxy for performance forecasts

The churn rate helps calculate future performances.

Strategies to reduce churn rate

As mentioned earlier, growth is inversely proportional to the churn rate, so keeping your churn rate as low as possible is essential. According to Lincoln Murphy of Sixteen Ventures, a 5-6% annual churn rate is acceptable, and less than 3% is considered magnificent.

Here are a few tips to bring down your churn rate:

- Collect feedback from churned customers

- Offer long-term contracts

- Reward your customers

- Offer a trial or freemium version of your product

- Send interesting emails

- Keep an eye on your competitors

- Market to existing customers and prospects alike

- Build valuable resources for your customers

Why is customer retention necessary?

Customer retention refers to the steps taken to retain your customers. Keeping your existing customers is necessary to drive repeat purchases, increase customer lifetime value, and build a network of loyal customers. Furthermore, it boosts your revenue and lets you oust your competitors.

Conclusion

Customer churn is inevitable, but you should not take it lightly. If left unchecked, it may risk your brand and reputation in the long run. Therefore, you must always keep a close eye on warning signs and take the necessary steps as soon as you spot a losing customer.

Develop strategies to nurture your relationship with existing customers and build a solid foundation with new ones. This will help keep your churn rate to the barest minimum while improving the customer retention rate. We hope this blog was helpful. For any more queries, you can contact us.